Paypal Business Loan Can Be Fun For Anyone

Wiki Article

Paypal Business Loan Fundamentals Explained

Table of ContentsAll About Paypal Business LoanThe Only Guide for Paypal Business LoanPaypal Business Loan for BeginnersThe Single Strategy To Use For Paypal Business Loan

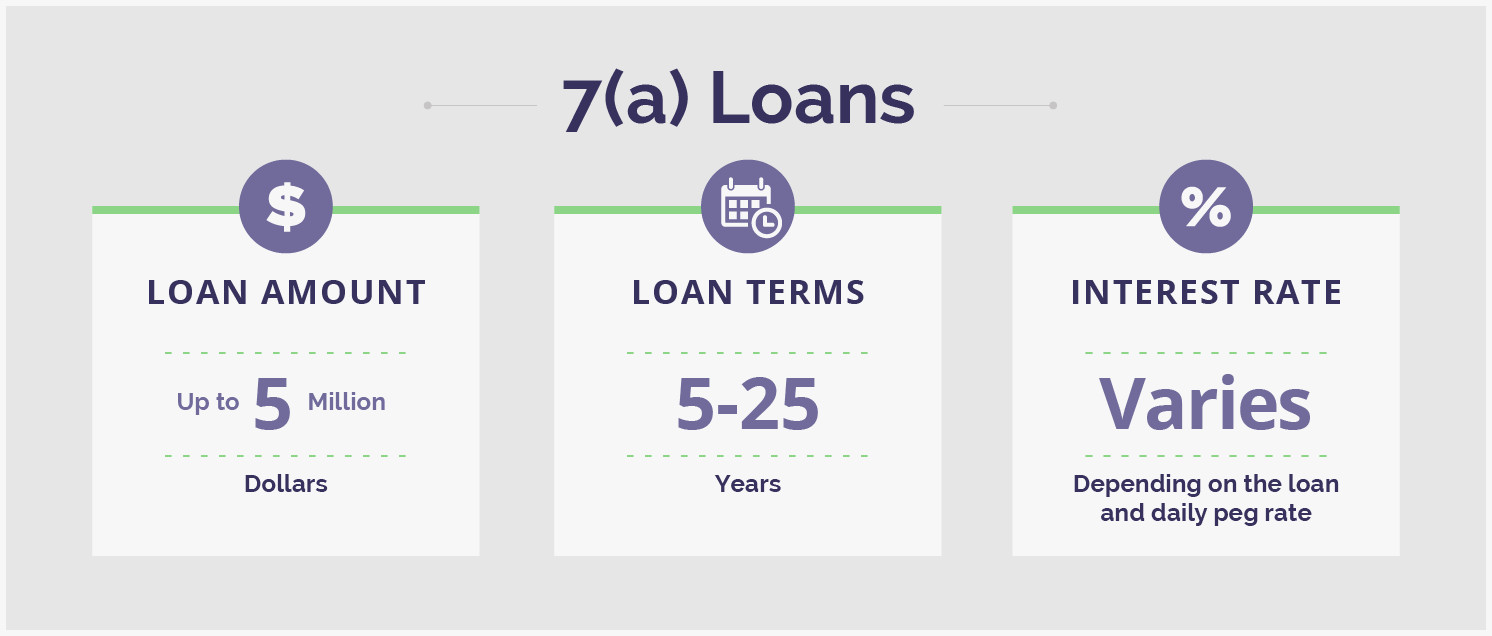

The SBA works as the guarantor between the borrower and also the lender (PayPal Business Loan). In return, lending institutions present their conditions, rates of interest caps and also various other criteria which require approval from the SBA.The SBA provides various plans and also you can select any strategy which could fit your company requirementfor instance, purchasing supply, paying debts or home loans, broadening your organization, or also for acquiring genuine estate.SBA fundings do need an extensive application procedure, a personal credit history check, as well as collateral requirements, so they aren't right for everybody. When you hear words "finance," a term funding from a major bank is most likely among the very first points that comes to mind. A term car loan is defined as a round figure, paid to a debtor with a contract to repay it over a collection period of time, with rate of interest - PayPal Business Loan.

All you have to do is to stay within that credit rating limitation. Utilize your credit sensibly as well as make prompt regular monthly settlements, and also you can use the credit history amount as numerous times as you like while building a positive credit scores background for your service. Company proprietors that do not have security or a strong sufficient credit score history to acquire term car loans can depend on company bank card for quick funding.

Financial debt spiral risk: It is very easy for balances as well as interest to load up if you are incapable to make your regular monthly payments in a timely manner. If you miss out on one payment, the unpaid equilibrium rolls over to the next payment period, and also you will certainly be charged interest on the brand-new amount, implying your next repayment will certainly be higher.

See This Report about Paypal Business Loan

This can swiftly create an ever-increasing opening of debt as well as it's extremely hard to climb up out without a huge infusion of money. Credit line: All service credit history cards feature limitations, as well as staying within your restriction can sometimes prove to be a trouble. You may get around this by utilizing multiple cards, or you might be able to work out higher restrictions in time.However, when it pertains to credit cards, you're at the grace of the credit rating supplier. Can not utilize it for all kinds of settlements: Local business owners that need quick funding to make payroll or pay rent generally can not make use of credit report cards to make these certain kinds of payments. Based on your individual credit: Also most organization bank card are still linked to the company owner's individual credit rating.

One advantage of a Seller Money Development is that it is fairly easy to get. An additional advantage is that local business owner can obtain the cash within a few days. It is not suitable for organizations which have few credit report card transactions, due to the fact that they won't have adequate transaction quantity to obtain approved.: In invoice factoring, the lending institution gets overdue invoices from you and also gives you many of the billing amount upfront.

Billing factoring allows you to obtain the cash that you require for your company without awaiting your customers to pay. The only problem with this kind of little business financing is that a bulk of your organization earnings have to come from slow paying invoices. You need to also have solid credit rating as well as a performance history of consistently-paying consumers.

Little Known Facts About Paypal Business Loan.

Let's take a thorough appearance at how Fundbox operates in order to recognize why it can be a good alternative for your company loan. Right here are some points to learn about Fundbox: Choice within hours: You can sign up online in seconds as well as additional hints get a credit choice in hours. As soon as you decide to register, all you need to do is connect your accountancy software or organization savings account with Fundbox.

If you pay early, after that the later fees can get eliminated. As a small company proprietor, you recognize that there are a great deal of financing options out there. We hope this guide helps you start to choose which option makes one of the most sense for you. Take into account the complying with data regarding your service before making your next step: Personal credit report: Take an appearance at your individual credit history.

Things about Paypal Business Loan

If your credit history is ordinary or low, then you will possibly need to pay higher rate of interest or you may be denied totally. Business credit score: Ensure that your service has a excellent credit rating, as the lending institutions will take your business debt right into factor to consider before approving it for a loan.If you can not click for more info wait, after that choose a quicker on-line small company financing choice. Service earnings: The lending options will vary depending upon the method your service creates earnings. By assessing the revenues of your business, you can choose repayment and procurement methods that work best for you. It used to be that a significant financial institution was just one of your only choices for obtaining access to a service line of credit click for more info rating, but not any longer.

Report this wiki page